From athleisure wear to shopping via social media, we wanted to know what consumers are saying about their apparel-buying habits. So, we surveyed 24,000 global shoppers to learn about the latest apparel industry trends.

One of the biggest apparel-related changes to come from the pandemic era? What people wear. 38% of people agree the pandemic changed the way they dress in social settings, and 35% agree it’s changed the way they dress for work.

And while some folks have reduced their spending during recent economic hardships, 28% of respondents said they’re still shopping just as much as normal.

But what are people buying, and where are they buying from? And where are they getting their inspiration and influence? And what actions to apparel brands need to take to win over future shoppers?

Apparel industry research: Key trends and takeaways

Our survey consisted of 24,000 shoppers from USA, UK, Australia, Canada, France, Germany, and Spain, segmented by age group:

- 18-24

- 25-34

- 35-44

- 45-54

- 55-64

- 65+

A small percentage (14%) opted not to give their age bracket. Now, let’s see what they had to say and the key takeaways for you to grow your apparel brand.

1. A majority of consumers will reduce at least some spending during hardships

In our current economy, many Americans are cutting back. According to Fidelity Investments, this year is “the year of living sensibly” amid consumer financial hardships, with over 40% of folks saying inflation is a top financial concern for them.

72% of consumers said they reduce their spending to some extent during periods of budgetary or financial pressure and 51% stated that they cut back on certain things but not others. This selective approach suggests consumers prioritize their expenses based on their perceived importance or necessity. Just 21% of respondents reported reducing their spending across all categories.

When it comes to the apparel industry specifically, the data shows us a noteworthy trend: only 6% of consumers said that they don’t reduce their spending on clothing at all during budget cuts, suggesting a majority of consumers will adjust their apparel spending in some way during times of financial hardship.

Out of the respondents who reduce their apparel spending, 49% say they reduce it “a bit,” while 46% say they reduce it “a lot.”

2. More people still buy apparel in-store than online

Despite the convenience and accessibility of online shopping, 58% of consumers stated that they tend to shop for apparel in-store rather than online.

However, the research process plays a crucial role in consumers’ purchasing decisions. Approximately 61% of respondents engage in online or social research before making a purchase (whether they end up buying through an e-commerce platform or in-store).

When you break the data down by age-specific demographics, the numbers are slightly different. Among consumers 55 and older, just 43% said that they engage in online or social research (for 18-to-34 year olds, that number jumps to 76%).

The takeaway for retailers? With research being important to many folks, it’s important to make sure your product pages are comprehensive and up-to-date.

Shopping on social is gaining traction

The majority of online shoppers tend to mainly shop on either retailer websites (65%) or brand websites (58%). 21% of consumers said they also shop on social media for apparel. For folks who shop on social media, they primarily buy from Instagram (23%), Facebook (22%), and TikTok (13%).

Digging deeper into the social shopping trend, the reasons behind these apparel purchases vary. 30% cite their liking for how the clothes looked in the social media posts, while 24% appreciate the ease of the online shopping experience.

For example, Like2Buy allows brands and influencers to curate a list of products and promotions for their followers. When a person or brand wants to share those products, they can simply share their Like2Buy link (or keep it in their bio), so shoppers can find exactly what they’re looking for and be taken directly to the product. Talk about a seamless, convenient experience!

Other factors that influenced buying decisions included recommendations from friends or family members (17%), effective ad targeting (13%), and influencer promotions (12%).

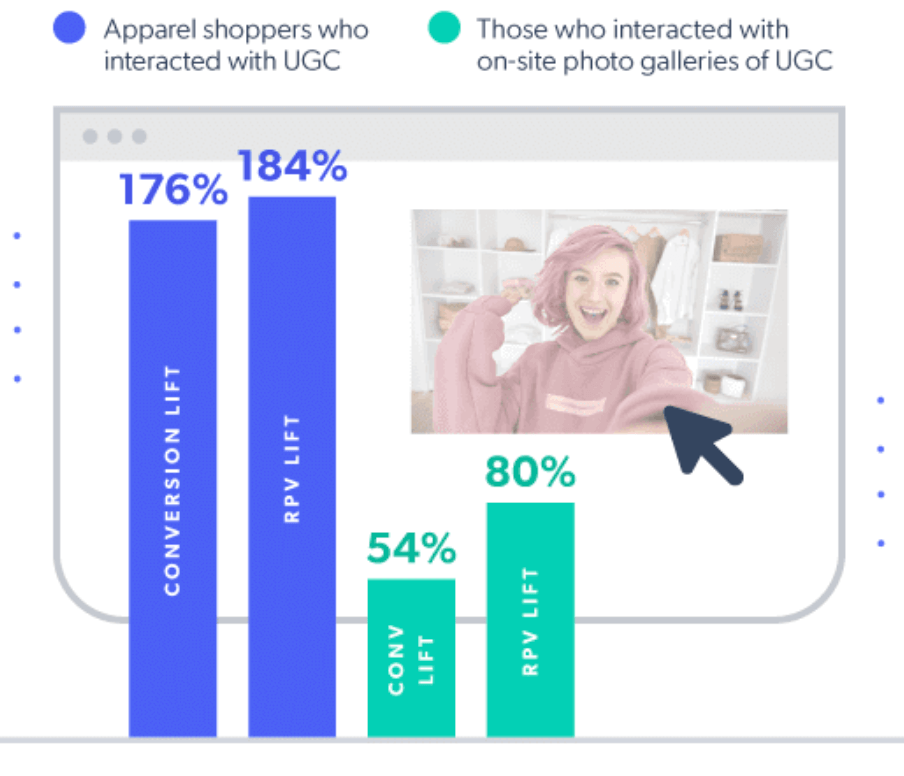

3. Over half of consumers trust UGC content over brand-generated content

User-generated content (UGC) — social images, product reviews, and videos created by an individual rather than a brand — is slightly dominating the apparel industry, with over half (54%) of consumers trusting UGC over brand-generated content. 46% of shoppers say they trust brand-generated content most.

Overall, 65% of consumers said it’s important to look at UGC before making an online clothing purchase. Looking at age-specific data, 85% of 18-to-34 year olds said it’s important to look at UGC content versus 46% of those aged 55+.

For in-store purchases, the numbers take a dip: 73% of 18-to-34 year olds and 33% of people 55 and over say they look at UGC before buying.

Where do shoppers find this content? Respondents said they primarily come across UGC on:

- Retail websites (35%)

- Brand websites (34%)

- Browser search results (27%)

- In-store displays (22%)

- A friend or family member’s social feed (20%)

UGC isn’t just a nice-to-have to please shoppers. From our own network data, we see apparel brands who utilize UGC achieve a significant positive impact on their revenue.

4. Millennials and Gen Z are inspired and influenced by online trends (Baby boomers? Not so much)

Age demographics clearly have an impact on apparel industry trends because when we look at what inspires and influences shoppers, there’s clear disparities between age groups.

For example, among 18-to-34 year olds, 53% stated they find inspiration in products they come across on social media. In contrast, only 8% of individuals aged 55 and older reported being influenced by products they see on social media. We see a similar pattern for influencer blogs — 21% of 18-to-34 years olds get inspiration from influencer blogs compared to only 2% of the 55+ age group.

Interestingly, it’s window shopping that still holds sway with older consumers. 47% of people over 55 indicated they find inspiration in products they discover while window shopping. (Only 29% of individuals aged 18-to-34 rely on this traditional method for inspiration.)

The influence of friends and family remains strong across all age groups, with approximately 33% of respondents finding inspiration from, and being influenced by, their close connections. This underscores the importance of personal recommendations and the power of word-of-mouth in shaping consumer behavior.

For those who find their inspiration on social media, the primary sources are everyday social media users (55%), a brand’s social media (48%), social media influencers (47%), and celebrities (28%).

5. Sustainability and second-hand shopping has slightly declined

Sustainability and eco-friendliness often play a role in today’s consumer purchasing decisions. When respondents were asked how important sustainability and eco-friendliness are when purchasing clothes, 57% said they’re “important” or “very important.” In the same apparel industry trends research we ran in 2021, 69% of shoppers had the same sentiment.

40% of respondents said they don’t pay attention to whether a brand is sustainable or fast-fashion. Rather, they make clothing purchases based on personal needs and preferences. 27% stated they buy clothing from both sustainable and fast-fashion brands, and 18% expressed a specific preference for purchasing sustainable clothing.

However, sustainability and second-hand shopping are other categories with significant differences between age groups. In looking at the data, it’s clear younger consumers prioritize sustainability and second-hand shopping more than older ones.

Age groups differ on sustainability and second-hand

- 66% of 55+ individuals said they “never” shop second-hand on platforms — only 26% of 18-to-34 year olds said the same

- 43% of individuals aged 18-34 reported shopping second-hand “very often” or “often” compared to just 11% of folks aged 55 and older

Additionally, 50% of the 18-to-34 age group reported they’ve purposely purchased clothing made from sustainable materials compared to 26% of those aged 55+. And 57% of 18-to-34 year olds said they would pay more for clothing made from sustainable materials versus 35% of the 55+ age group.

When asked about the reasons behind their second-hand purchases, several key motivations emerged. Saving money ranked as the top reason, with 59% of respondents identifying it as their primary driver. Other factors included the desire for more environmentally sound choices (38%), the fact that high-quality clothes are more affordable this way (38%), reducing the demand for fast fashion (29%), promoting sustainable fashion (29%), seeking more unique items (27%), and recognizing that second-hand items often last longer (23%).

To encourage consumers to purchase more sustainable clothing, brands can adopt various strategies. Our respondents suggested that brands:

- Offer discount vouchers (52%)

- Provide gift cards (32%)

- Offer extra loyalty points (32%)

- Give more details about how and where the products are made (29%)

- Provide clear labeling with appropriate ecolabels (24%)

- Make donations to a good cause when sustainable clothing is sold (22%)

- Disclose the supply chain and environmental impact data (17%)

While some of these responses are monetary or reward-based, several aren’t — showing it’s not just about the cost.

Another industry trend among environmentally conscious apparel consumers is clothing rentals. Before 2020, only 13% of folks said they’d used a clothing rental service. Now, that number is up to 62%. By age groups, 61% of 18-to-34 year olds said they’ve used a clothing rental service, while 42% of 55+ individuals said they have.

6. Shoppers still want athleisure and casual clothes more than other categories

The data from this year shows us that athleisure and casual clothes are still just as popular as they have been over the last few years.

When shoppers were asked what categories of apparel they spent the most on in the past 12 months, 59% said casual wear, and 37% said casual footwear.

Casual wear also dominates the social e-commerce landscape, accounting for 60% of purchases. Sportswear follows closely behind at 41%.

The comfy-clothing trend applies to second-hand shoppers, too: Among the folks who purchase second-hand items, 62% said they primarily purchase casual wear. Other popular categories include children’s clothes (29%), party attire (29%), special occasion clothes (27%), luxury wear (25%), office wear (23%), and maternity clothes (13%).

For the people who subscribe to clothing rental services, comfort is a priority — 36% say they rent casual wear. They also rent special occasion clothes (37%), party wear (34%), luxury clothing (34%), children’s clothing (28%), office wear (28%), and maternity wear (21%).

7. Consumers prefer personalization when shopping for apparel

When asked if they prefer a personalized experience from brands and retailers (e.g., recommendations, using your name, or offers tied to your interests), 41% of shoppers said yes, while 36% said no. Breaking down the responses by age groups, more than half (57%) of 18-to-34 year olds prefer personalized experiences from brands and retailers, whereas only 24% of individuals aged 55 and above shared the same sentiment.

Keep this in mind as you serve your Gen Z and millennial customers since personalization matters to them.

We also asked shoppers about their preferences for customization services like monograms or custom tailoring. 50% of people said they would not pay more for these types of services. Of the shoppers who would pay more, it would most likely be for clothing customized to their exact body measurements (27%), custom styling (19%), custom tailoring (18%), fully customizable fabrics (13%), and custom wording or monograms (9%).

8. Nearly a quarter of shoppers are interested in smart clothing

Smart clothing refers to garments equipped with technology to monitor the wearer’s physical condition or location. These kinds of clothes are gaining traction, especially among more active shoppers and outdoor enthusiasts. When we asked consumers if they’d purchase smart clothing, 24% expressed an interest, while 53% indicated they wouldn’t — 24% said they weren’t sure.

Among those who did express interest, 37% were aged 18-34, while 11% were 55 and older.

In terms of specific features, respondents identified a few types of smart clothing that would pique their interest. If you’re looking to get started on the smart clothing industry trend for your apparel brand, the top preferences include clothing that:

- Auto-adjusts temperature (54%)

- Tracks physical strain to aid in recovery (42%)

- Monitors stress levels (41%)

- Tracks heart rate (40%)

- Monitors UV exposure (39%)

- Has its location tracked (27%)

Future apparel industry trends

Three-plus years since the onset of the pandemic, shoppers are still gravitating toward comfortable clothing. Clothing standards for both work and social settings have shifted — casual clothing is much more acceptable now, even in some corporate settings. Today’s consumers are looking for versatile pieces that can seamlessly transition from professional to casual environments.

But looking forward, we’re also seeing social media evolve from being simply a place of inspiration and influence to a place where people can directly purchase clothing items. Remember, over 20% of consumers said they use social media as one of their main channels for clothes shopping.

And UGC can help boost your social sales: 47% of 18-to-34 year olds said that it’s very important to look at user-generated content before they buy clothing online. UGC is authentic and relatable to your followers, and it allows you to curate your content so it resonates with them. Apparel brand EziBuy saw a 325% increase in revenue per visitor with UGC and clothing giant GANT utilized UGC to reduce return rates by 5%.

To learn more about the e-commerce trends we’re seeing beyond just the apparel industry, watch our on-demand masterclass from award-winning CMO Zarina Stanford: Commerce trends and predictions: The winning formula.

Bazaarvoice is the leading UGC platform, and we help companies transform their online brand and marketing strategies with user-generated content. Request a demo today to learn how.

Get started